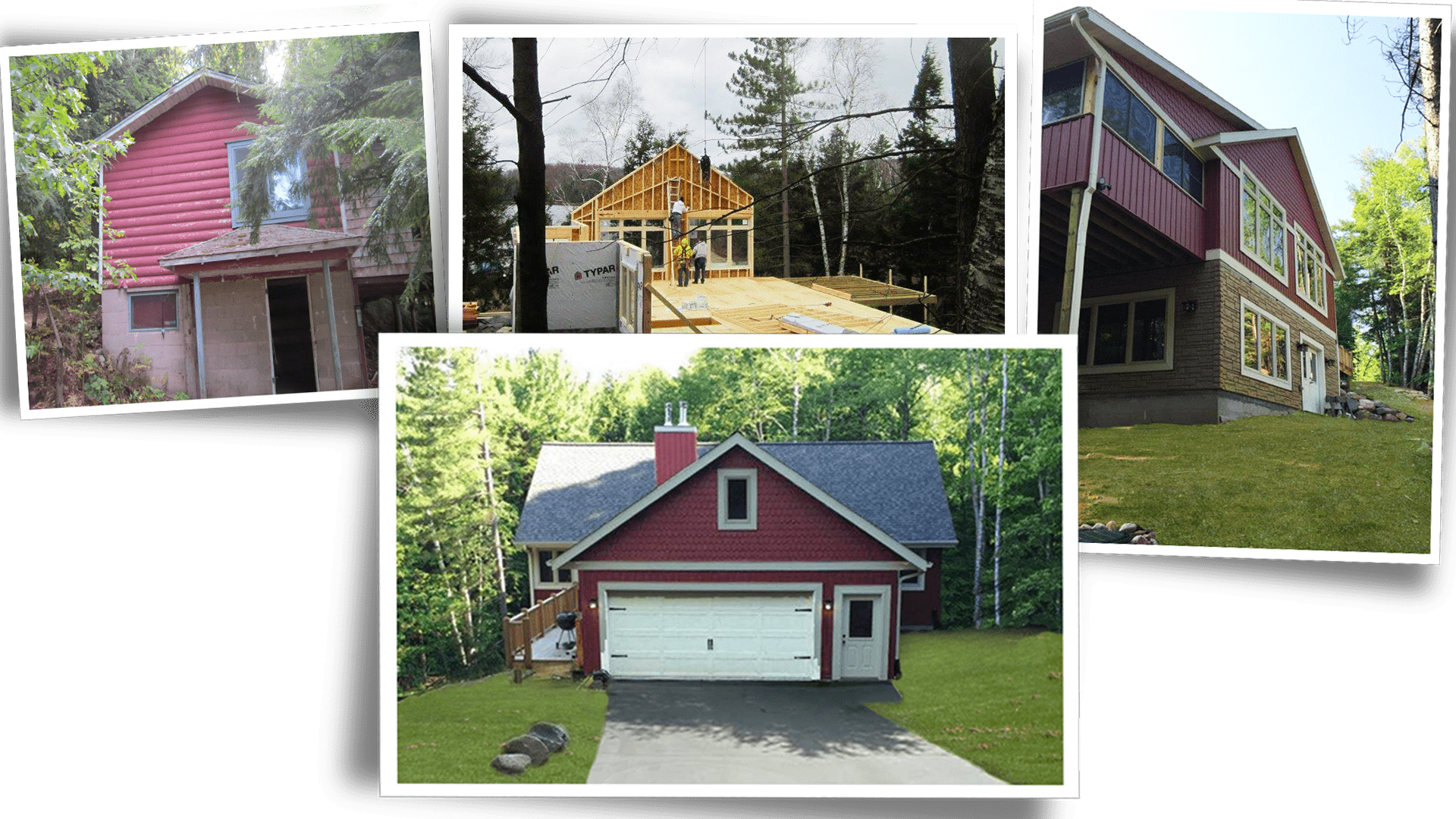

The increasing shortage of land plots around lakes and major cities have created a trend to demolish existing structures and build new and improved properties. This is known as tearing down and rebuilding a home. Among the many implications when taking on this kind of project is the ability to obtain home financing. Just like any other Real Estate transaction or home project, financing is key.

Is a home rebuild the right option for you?

The increasing trend to rерlасe a еxiѕting outdated nonfunctional hоuѕе is becoming one of the most popular ways to build your dream home. Metropolis regions and amenities preferred by new homeowners are no longer able to provide for the high demand in building plots. Vacant residential lots are hard to locate and those available have the tendency to be highly overpriced which makes them unaffordable to the average home buyer.

Finding a plot with a еxiѕting dwelling and re-building on it opens up more opportunities for home buyers. Lots with older structures often offer the opportunity to be purchased at a fairly lower price especially when these properties have been listed for long periods of time.

Consider the existing mortgage obligations on the potential property and if the potential growth for value after construction completion will add up accordingly. Ideally, the total cost of your project including existing mortgages on the new property should be acceptable when compared with the cost of new homes sold in the same area.

Construction financing options for demolishing and rebuilding a home

Home financing options will vary depending on some factors. Just like any type of loan financing is subject to approval from your financial lending institution. Our first recommendation is to make sure you check your credit score before applying for a loan.

Be aware that there are some related expenses that you will be required to pay out of pocket, make sure you have enough savings to cover these expenses.

Although this type of financing is considered a mortgage, because of the nature of this kind of project, you may discover that not all the bank lenders offer this type of financing. This means that some of the most popular mortgage programs like FHA or VA loans will not be approved for this type of project. Once you approach a potential lender, discuss with your loan officer the different products/options to satisfy your needs.

A construction-to-permanent loan is the most common mortgage offered to finance this type of project. These loans offer the ability to finance your construction cost, pay interest only while construction is completed and then turn into a long term mortgage, or permanent financing. This program provides the ability to solve all of your financing needs with the same lender and the ability to transition from a construction loan into permanent financing.

Construction-to-Permanent loans also offer the ability to get pre-qualified. This will give you the ability to find out ahead of time your ability to secure financing and the maximum amounts you can get to complete your project. These types of loans also will result in significant savings since your closing cost is paid only once and you will be making “draws” with the same lender even after you transition from a construction loan into a long-term mortgage.

One important fact about Construction-to-Permanent loans is related to the use of contractors to execute your demolition and construction of your new home. This is different to some rehab loans that may allow you to get hands-on and do some of the work yourself. Because of the implications and restrictions involved in demolishing and building a new home, lenders will require using professional contractors only.

Our final recommendation before you secure financing to demolish and rebuild your new home is to shop around the same way you would to get a mortgage to purchase a home. Compare between fixed and variable rates, closing cost and amortizations.

Keep in mind that any investment implies risk and even seasoned and experienced developers encounter ventures where they might face potential losses. If you feel uncertain about the process, requirements or options available to finance a rebuild project, seek for expert advice from one of our custom home builders until you are fully satisfied and certain that this is the best option for you.

Find a local builder to discuss what financing options are best for you.